Home › Platform › Simulation Tools › Taxpayer Receipt

BALANCING ACT

Polco’s Taxpayer Receipt

Bringing transparency to public spending

Understanding how tax dollars are allocated and spent is crucial for fostering trust between local governments and their residents. Polco’s Taxpayer Receipt tool provides a clear, personalized breakdown of how taxpayers' contributions are utilized within their communities. This innovative solution empowers citizens with the knowledge they need to engage meaningfully in local governance.

What is the Taxpayer Receipt?

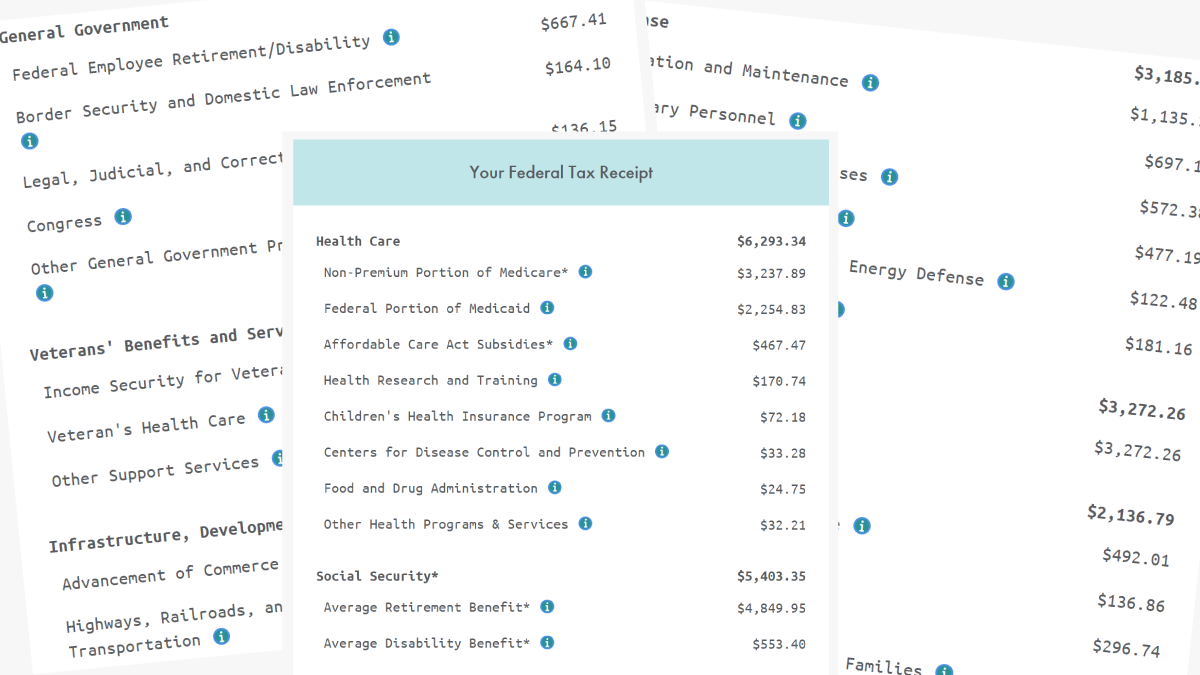

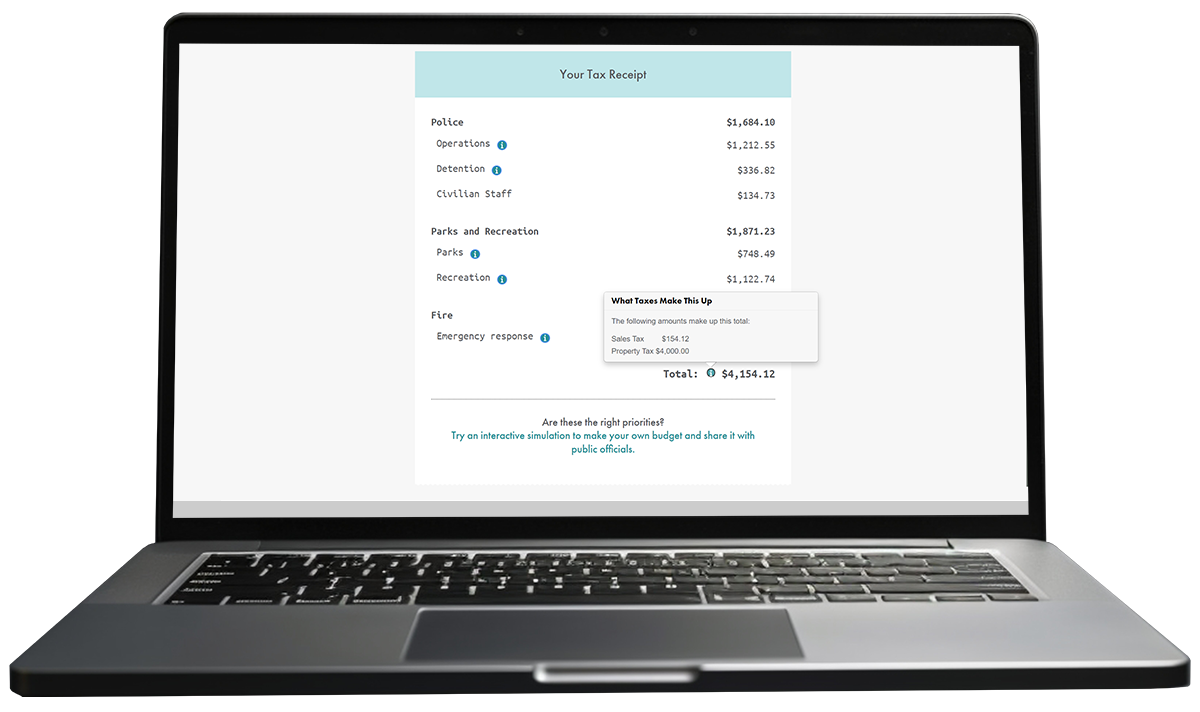

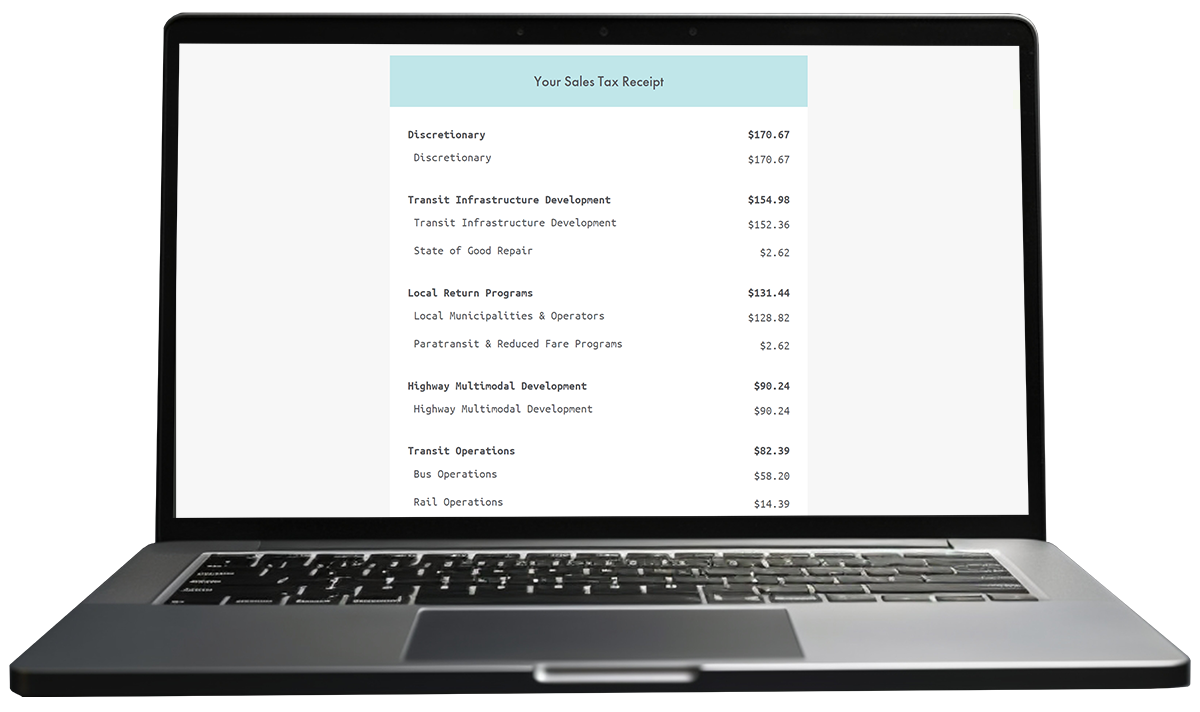

Polco’s Taxpayer Receipt is an interactive, user-friendly experience that enables residents to see exactly where their tax dollars go. By entering their financial information, users can generate a customized receipt that details the distribution of their taxes across various public services and programs, such as education, public safety, infrastructure, and more. This transparency helps residents understand the value they receive from local government services, fostering informed discussions and engagement.

Key features of the Taxpayer Receipt

Empowering citizens with transparent financial insights

Foster Transparency

Tailored Calculations: Residents can input their tax information to receive a customized breakdown of how their tax dollars are spent, making the data relevant and personal.

Comprehensive Service Overview: View detailed allocations across various categories, such as education, healthcare, public safety, and infrastructure, giving a complete picture of local government spending.

User-friendly interface

Intuitive Design: The platform is designed to be easy to navigate, ensuring that residents of all backgrounds can access and understand their taxpayer receipt without confusion.

Clear Understanding of Public Spending: The tool demystifies how local governments use tax dollars by providing a clear, personalized view of public expenditures. This transparency helps build trust between residents and their local government, as it shows exactly where their money is going.

Supports Financial Literacy

Building Financial Awareness: By helping residents understand where their money goes, the Taxpayer Receipt tool promotes long-term financial literacy within the community. Over time, this leads to a more engaged, financially informed populace that is better equipped to participate in local governance.

Sustained Trust Over Time: As residents repeatedly receive taxpayer receipts and see their input reflected in government actions, trust in local government builds over time, leading to more collaborative and productive relationships between government and citizens.

Enhanced Civic Engagement

Educating Residents: The detailed breakdown of spending categories helps residents better understand the importance of taxes and how they fund critical public services. This educational component encourages residents to become more engaged in civic matters and informed about the impact of government programs.

Informed Discussions: When residents can see exactly how their taxes are spent, they are more likely to participate in discussions about budget priorities and policies. The receipt fosters informed community dialogue, enabling residents to make more meaningful contributions during public meetings or consultations.

Personalized Breakdown

Individualized Receipts: The tool generates a detailed, personalized receipt for each resident based on their specific tax contributions. This receipt outlines how their taxes are allocated across different services and departments, such as public safety, education, healthcare, infrastructure, and parks.

Detailed Categories: Tax expenditures are divided into detailed categories, making it easy for residents to see exactly how much of their money is spent on services like law enforcement, fire protection, road maintenance, libraries, and social services.

The benefits of using our Taxpayer Receipt

Enhancing trust and accountability in local governance

Increased transparency

Empowered citizens

Strengthened community dialogue

Informed decision-making

Why you need Polco's Taxpayer Receipt

In today’s environment of increasing public scrutiny and demand for transparency, Polco's Taxpayer Receipt tool is essential for fostering community trust and engagement. By openly sharing how tax revenues are allocated, local governments can build credibility with residents and encourage accountability in budgeting decisions. When citizens have clear insights into how their tax dollars are spent, they are more likely to participate in community forums and discussions about local governance, ultimately leading to a more informed and engaged citizenry.

Furthermore, the Taxpayer Receipt empowers residents to advocate for the services that matter most to them, whether it’s education, public safety, or infrastructure. This enhanced understanding of tax allocations encourages constructive conversations about budget priorities and promotes fiscal responsibility. As civic literacy improves, so does the ability to collaboratively address local issues, strengthening the bond between residents and their local government. By adopting Polco's Taxpayer Receipt, communities can not only promote transparency but also cultivate a more engaged and informed populace, ready to shape their future.

Insights that build stronger communities

Stay informed with expert-written articles that explore the latest in civic engagement, public data, and community innovation. From success stories to practical how-tos, these blog posts offer fresh ideas and proven strategies to help public leaders connect with residents and make smarter, data-informed decisions.

What Residents Learn When You Show Them the Trade-Offs

The Winter Budget Challenge: Why Transparency Matters Now More Than Ever